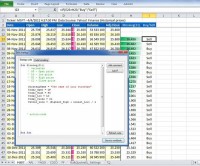

BacktestingXL Pro is an add-in for building and testing your trading strategies in Microsoft Excel 2010 or higher.

Users can use VBA (Visual Basic for Applications) to build strategies for BacktestingXL Pro. However, VBA knowledge is optional – in addition to using VBA-constructed trading rules, you can construct trading rules on a spreadsheet using standard pre-made backtesting codes.

Sample backtesting strategies are available for free. They demonstrate how BacktestingXL Pro can be efficiently applied.

BacktestingXL Pro supports advanced functionality, such as pyramiding (change of position size during an open trade), short/long position limiting, commission calculation, equity tracking, out-of-money controlling, buy/sell price customizing (you can trade at Today's or Tomorrow's Open, Close, High or Low prices). Such functionality enables you to build «natural» trading strategies and prevents you from putting your strategies in «frames.«

BacktestingXL Pro creates informative and highly detailed strategy test performance reports. Each report has seven tabs:

- Summary Report – the most important backtesting results in a compact form

- Data Series Report – trades, equity and profit/loss dynamics displayed in tabled and chart formats

- Trades Report – trades grouped by positions

- Trades (chronological) Report – trades in chronological order

- Signals Report – all signals produced by a strategy and their results (order processed or not)

- Settings Report – all configuration settings

- Strategy Code Report – containing raw strategy code.

Features Summary:

- Simple strategy creation

- Strategy code can be developed using Excel or VBE (Visual Basic Environment)

- 7-page informative and detailed strategy test performance report

- Equity tracking (initial capital and commissions)

- Separate long and short position limitations

- Pyramiding support